modison metals

Printed From: The Equity Desk

Category: Investment Ideas - Creating winning portfolios!

Forum Name: Stock Synopsis

Forum Discription: A bried discussion of companies on very specific matters. Normally this is the prelude for further research as always members would be discussing quality companies with good management only

URL: http://www.theequitydesk.com/forum/forum_posts.asp?TID=2878

Printed Date: 21/Apr/2025 at 1:20am

Topic: modison metals

Posted By: hit2710

Subject: modison metals

Date Posted: 15/Jul/2010 at 7:44pm

|

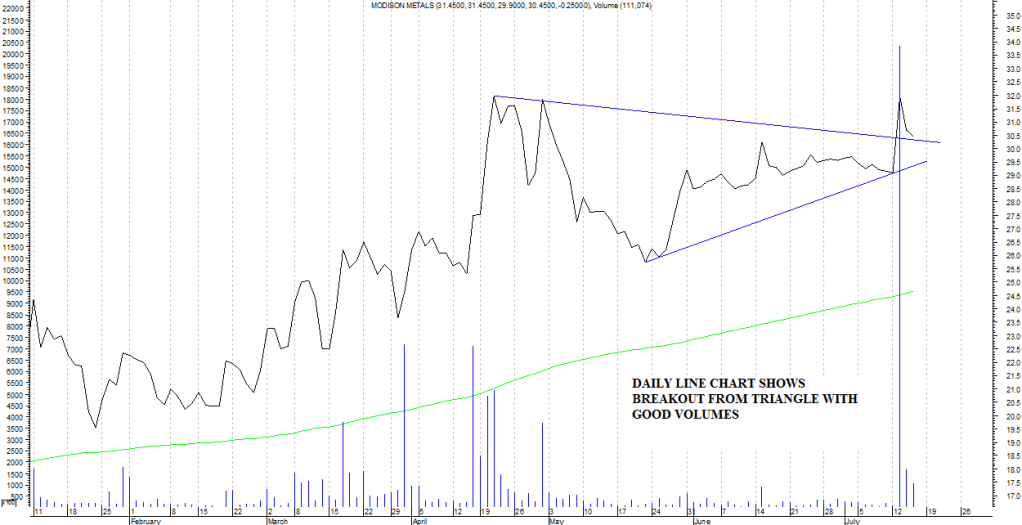

MODISON METALS BSE CODE 506261 CMP 30-31 FV Rs 1 CURRENT MARKET CAP 100 CRORES, BV 18.76 THE COMPANY IS INTO ELECTRICAL CONTACTS AND SILVER FLATWARE, ALTHOUGH SILVER FLATWARE CONSISTS OF LESS THAN 1% OF TOTAL REVENUES. THE ELECTRICAL CONTACT DIVISION OFFERS CONTACT PARTS FOR ARCING AND MAIN CURRENT CARRYING CONTACTS. THESE ARE MAINLY USED IN MEDIUM AND HIGH TENSION SWITCH GEARS. FY 10 SALES 103 CR (VS 86 CR IN MARCH 09) FY 10 NP 11.8 CR ( VS 7.43 IN MARCH 09) EPS FOR FY 10 3.5 DIV FOR FY 10--- 0.75 Rs per share ROE 19 OUTSTANDING SHARES 3.25 CRORES A LOOK AT THE LAST SIX QUARTERS SHOWS GOOD NUMBERS FOR THE LAST TWO QUARTERS WITH IMPROVEMENT IN SALES AND MARGINS.

WITH DEMAND FROM THE SWITCHGEAR SEGMENT SET TO IMPROVE, THE FUTURE FOR THIS COMPANY LOOKS BRIGHT. CONCERN: PROMOTER HOLDING HAS BEEN GOING DOWN FROM 76 TO 52 % SINCE LAST SIX QUARTERS. (If anyone can explain this phenomenon, it will be helpful) TECHNICALS----I WILL BE PUTTING UP CHARTS IN NEXT POST. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Replies:

Posted By: hit2710

Date Posted: 15/Jul/2010 at 7:50pm

------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: hit2710

Date Posted: 15/Jul/2010 at 7:54pm

------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: nav_1996

Date Posted: 15/Jul/2010 at 9:14pm

| Why don't we stick to something like Pennar which has same PE, better div yield, 20% growth, 10 times larger and diversified product portfolio. |

Posted By: TCSer

Date Posted: 15/Jul/2010 at 9:30pm

|

pennar crashed today any specific reason |

Posted By: nav_1996

Date Posted: 15/Jul/2010 at 10:20pm

| No idea. No news. Fundamentals look intact. Found their analyst prestation informative. Looks like they will get into wagon manufacuring. Time to add more if there is no -ve development. |

Posted By: hit2710

Date Posted: 15/Jul/2010 at 11:06pm

Different sectors, different prospects. I have no problems with Pennar as well. Modison caught my attention due to its chart and volume pattern and on digging, I found that fundamentals also look good. I think it might be at an inflection point. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Alok Bhola

Date Posted: 19/Jul/2010 at 12:46pm

The Promoter holding has gone down only marginally, from 76% to 72% over the past 4 quarters. The reason why its appearing as 52% for the March 2010 quarter is because a few of the Promoters are now appearing under the Public > 1% category, rather than the Promoter category. That might be due to some technical reason due to which they are no longer classified as promoters. Following are the details of their holdings for June 09 and March 10 quarters. The entries marked in blue have shifted from Promoter to Public > 1% category over the period. Name Mar10 Jun09 Chg Girdhari Lal Modi 49.3 49.3 0% Prakash Chandra Modi 46.6 42.0 11% 16.4.10** Raj Kumar Modi 41.9 41.9 0% Sanwar Mal Mody 50.6 49.7 2% Suresh Chandra P Mody 2.3 2.3 0% Ginidevi Modi 0.0 12.0 -100% Kumar Jay G Modi 17.5 8.5 106% Nirmala D Mody 8.2 8.8 -7% Mahesh Kumar P Mody 0.0 7.3 -100% Omprakash Modi 4.5 5.2 -13% Lalitadevi Modi 3.5 3.5 0% Rama Sanwarmal Modi 5.8 5.8 0% Sarla Girdharilal Modi 2.7 2.7 0% Vijay Kumar Modi 0.0 2.3 -100% Rameshchandra P Mody 0.0 2.5 -100% Others 0.3 2.8 -88% Total (lakh shares) 233 247 -5.4% 72% 76% **Prakash Chandra Modi increased his stake by 11% through open market purchases on 16.4.10. |

Posted By: hit2710

Date Posted: 19/Jul/2010 at 1:57pm

|

Thanks Alok. This was a sort of dark c**** and now u have cleared it. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Alok Bhola

Date Posted: 29/Jul/2010 at 9:36pm

|

http://www.indiainfoline.com/Markets/News/Modison-Metals/3202016433 - Modison Metals expects net sales of around Rs 130 crore for FY11 Overall, the company expects net sales of around Rs 130 crore for FY'11 as against net sales of around Rs 98 crore for FY'10. The company can leverage the existing capacity and according to the management, the margins for the year would be higher than previous year. The company is very bullish on future growth as well. It plans to incur a capex of about Rs 10.50 crore during the year on plant and machineries for the future growth of business. The company is the only player which is approved by Areva Globally for GIS business. Infact, Areva China is sourcing its contact requirement from the company since they are not satisfied with the quality of the Chinese contacts. |

Posted By: deneb

Date Posted: 29/Jul/2010 at 10:31pm

|

I dont think INDO Asian Fuse gear comes as a competitor but this might through some light in to the potential of the stock. Thanks hit Legrand had made an offer to buy the switchgear business of Indo Asian Fusegear Ltd for a consideration of Rs 600 crore. Indo fuse gear present mcap is 200Cr. http://economictimes.indiatimes.com/news/news-by-industry/cons-products/electronics/Legrand-to-buy-Indo-Asian-Fusegear-switgear-biz-for-Rs-600-cr/articleshow/6205153.cms - http://economictimes.indiatimes.com/news/news-by-industry/cons-products/electronics/Legrand-to-buy-Indo-Asian-Fusegear-switgear-biz-for-Rs-600-cr/articleshow/6205153.cms Regards, a/- |

Posted By: hit2710

Date Posted: 09/Aug/2010 at 1:41pm

Modison going strong above 40.

There is a recommendation in gujarat samachar on this one in their weekly pick. ------------- Stockmarket is a weird place. For every person who buys a stock there is a person who sells it and both think they are very smart. |

Posted By: Alok Bhola

Date Posted: 12/Aug/2010 at 6:40pm

| Pretty decent performance. Revenues grew 69% and EPS grew 65% YoY. What is more interesting is, owing to very low EPS base for Q2FY10, the EPS growth for the next quarter is likely to be around 100%, resulting in 1 quarter forward P/E of just 8.5 for an almost debt free company that has grown by about 20% annualized over the past 5 years (and is expected to maintain 20-25% growth rate over the next 5 years as well). |

Posted By: TCSer

Date Posted: 22/Aug/2010 at 11:49pm

| Capitalmarket has been positive on this stock n has predicted an EPS of around 5 for march 11 implying a price target of 50 in medium term. |

Posted By: Ravenrage

Date Posted: 24/Aug/2010 at 9:54am

| CNBC TV18 says Modison Metals has a board meet to approve a new business . Maybe will be a momentum generator . |

Posted By: Alok Bhola

Date Posted: 25/Aug/2010 at 9:39am

|

Does anyone know the details of the new business referred to http://www.bseindia.com/stockinfo/anndet.aspx?newsid=8d6f2345-085f-457c-8190-8cc46f36c3a4 - here ? |

Posted By: TCSer

Date Posted: 28/Aug/2010 at 5:51pm

|

Capitalmarket recommendations have often turned out to be quite accurate specially during current bullish times . We have seen examples of cox & kings,Khaitan fertlizers, Camlin n several others just zooming. I wonder when will Modison start its upward swing. |

Posted By: satsandh

Date Posted: 29/Aug/2010 at 7:04pm

|

Same for Hitesh's recommendations too Hoping it should do well when the market begins its next upmove.

|

Posted By: Rishant007

Date Posted: 01/Nov/2010 at 1:48am

|

I wanted to reiterate that Promoter holding has not gone down. It has been reschuffled.

The prom holding under Promoters is what is visible. If one checks under Public holding the promoters has sold from 1 acc to another and that account falls outside of "Promoter holding catergory". Hence the diff from 72 to 52%.

The company has good plans and its rev has always grown from last 5 years except for 2009 when there was a global meltdown.

It would be interesting to see what plans company have as they have got shareholders approval but they haven't elaborated what segment they will invest in.

Any takers?

|

Posted By: TCSer

Date Posted: 01/Nov/2010 at 2:12am

|

the scrip has been underperforming for quite some time why |

Posted By: paulinasu

Date Posted: 02/Nov/2010 at 4:20pm

|

More than 70% of the raw material cost for Modison is accounted for the cost of Silver, which is used for making the electrical contacts. I feel that the prices of silver which is very high presently may eat in to the profits made by Modison. |

Posted By: Market Maniac

Date Posted: 09/Feb/2011 at 1:57am

|

Fair Co.

http://www.modison.com/mml/pdf/crisil_research_report.pdf |

Posted By: Rishant007

Date Posted: 26/Jul/2011 at 9:09pm

| did anyone attend AGM today? |

Posted By: Rishant007

Date Posted: 31/Oct/2011 at 10:35pm

|

The stock has rocked in this falling market since last month... It has moved from 29 levels to 49 levels....

|

Posted By: commnman

Date Posted: 02/Feb/2012 at 7:22pm

|

Q3/Fy-12 Results out...

Total Income up 58.4% to 44.56 Cr from 28.14 Cr. EBIDTA up 12.3% to 7.76 Cr from 6.91 Cr. Net Profit up 6% to 3.95 Cr from 3.73 Cr. EBIDTA margin is 17.4% V/s 19.6% (SQ-11) and 24.6% (DQ-10) NET Pr margin is 8.9% V/s 10.5% (SQ-11) and 13.3% (DQ-10) Total Raw material costs as a %ge to Income is 68.5% V/s 68.9% (SQ-11) and 57.1% (DQ-10) Employee costs to Income is 4% V/s 3.4% (SQ-11) and 5.9% (DQ-10) Other expenses to Income is 10.1% V/s 8.1% (SQ-11) and 12.4% (DQ-10) Interest expense to EBIT is 10.8% V/s 8.5% (SQ-11) and 4.4% (DQ-10) Tax Rate is 31.5% V/s 32% (SQ-11) and 33% (DQ-10) Almost 90% jump in Raw materials to 30.5 Cr from 16.07 Cr affected EBIDTA. Then, Sharp rise in interest expense of 0.69 Cr v/s 0.25 Cr affected Net profit. 9M/Fy-12 v/s 9M/Fy-11: Total Income up 42.8% to 125.32 Cr from 87.77 Cr (Fy/10-11: 127.07 Cr) EBIDTA up 27.7% to 25.32 Cr from 19.83 Cr (Fy/10-11: 29.3 Cr) Net Pr up 28.4% to 13.51 Cr from 10.52 Cr (Fy/10-11: 15.84 Cr) Reported Nine-Month EPS 4.16 V/s 3.24 (Fy/10-11: 4.88) - ------------- main toh aam aadmi hun... jo sunta hoon wohi sach maanta hoon |