Seamec Ltd

Printed From: The Equity Desk

Category: Investment Ideas - Creating winning portfolios!

Forum Name: Stock Synopsis

Forum Discription: A bried discussion of companies on very specific matters. Normally this is the prelude for further research as always members would be discussing quality companies with good management only

URL: http://www.theequitydesk.com/forum/forum_posts.asp?TID=2699

Printed Date: 20/Apr/2025 at 11:35am

Topic: Seamec Ltd

Posted By: vinvestor2010

Subject: Seamec Ltd

Date Posted: 19/Mar/2010 at 9:03pm

|

OK just to get the ball rolling I am just posting my analysis of SEAMEC here

Biz Description

Seamec Ltd has 4 vessels which it gives for support in Oil Drilling , Platform Maintenance and Diving Support etc

The company leases out these vessels on a long period charter basis on a rate of say $100000 per day (best case), something like Aban Offshore's model

It is a 70-75% owned subsidiary of a French company called Tunip

The company is valued at about Rs 700 cr, the EV is about Rs 650 cr due to some cash on books last year. There is no debt

The current low valuation is due to an extra-ordinary period last year and might not count as a regular event. The PE on a normalized basis is about 8-10 on last 3-4 years earnings

I did a simple SWOT analysis of its business I would like to know if I am on the right track hopefully

Strengths

The company operates with excellent capital discipline - no debts and no dividends i.e. whatever is earned goes right back in the business (see the annual report also for their attitude)

They even terminated customer contracts for non payment and recovered money from them(obviously they know they are in demand)

The Diving Support Vessels seem to command a premium price of some sort as a result even Dolphin Offshore a competitor leases their vessel

Being a subsidiary of a global firm they should be able to get orders from a wider area

Compared to companies like Aban the balance sheet is in much better shape

With the exceptional earnings this year the company should end with at least 150-200 cr of cash against a market cap of 700 cr, though this may be reinvested or used for buyback

Weaknesses

The vessels are having an average age of 10-20 years , they may need upgrades or replacements(the excess cash could be used for this)

The company must put its vessels in a dry dock i.e. if a ship is used for a certain period, after that it must be sent back for maintenance by law that means lost revenue

With 75% of the company the owners might not be inclined to be minority shareholder friendly and through charges like management fee can drain it of its value

Opportunities

Oil Prices are expected to be high for sometime to come with Auto sales in India , China and rest of Asia remaining high. This should result in continued demand for their services

The parent firm owns 75% and with excess cash may choose to do a buyout like Sulzer through an open offer which could be a catalyst

Threats

Competition from other companies as this seems to be a high profit low turn business

The stock has already run up considerably starting from the Rs 50 or so levels in last March

With 4 vessels if any one goes out of service due to accident, fire or the standard dry dock period , earnings will slip temporarily as in 2007. They truly have their eggs in 4 baskets

Would like to know if u ppl think this is a worthy investment , if yes why, if no why ??My understanding of the oil gas and shipping businesses is limited, I have gone primarily on Financial analysis.

The sorrowful saga of Cranes Software my no 1 mistake i will discuss later

Many thanks all

|

Replies:

Posted By: Rehan

Date Posted: 19/Mar/2010 at 9:59pm

| http://www.myiris.com/newsCentre/storyShow.php?fileR=20100203121032199&dir=2010/02/03 - http://www.myiris.com/newsCentre/storyShow.php?fileR=20100203121032199&dir=2010/02/03 |

Posted By: manish_okhade

Date Posted: 21/Mar/2010 at 8:58pm

| Such companies are investor's dilemma. They need huge inbvestment to buy new vessels to expand the business and it always comes from debt. Now smart marine companies take the debt in down time when its cheap and encash the proceed in up time. Business is cyclical and expansion is highly cap-intensive. Oil price is always a factor, I feel GESL is a better choice for long term investor due to its financial muscel. They are servicing the debt EMI by their interest incom from investmemnt alone (it has 200/- per share cash!!!). |

Posted By: amitkhatri_99

Date Posted: 02/Sep/2010 at 2:21pm

| IS this silence before before big breakout As three ships are on board |

Posted By: samir767

Date Posted: 25/Sep/2010 at 11:49am

|

Hi ,

the base of seamec is that its in the oilfield services business.

the biggest threat which seamec faces is the cylical nature of this industry. as rightly pointed out oil swung from 133 to 40 odd levels, how are oil companies gonna plan their capex and upgradation activities with such wild swings. they would prefer to wait and this is where service companies get hit the most.

Other threat is on uncertanities which arise , remember gulf of mexico indicent just a few days back. one legislation passed and all new activities were stopped. small companies would be just wiped out.

The other problem with providing services is that you have to be at the top of your game, oil has become harder to find and with that the level of sercives to be provided have become much more complex, if you are not upgrading and evolving technologically then you are out of this business or loose your pricing power.

however alls not lost ( as ever the optimist i am

the most natural and decisive advantage which seamec has over others is that its parent company is Technip. Technip is one of the worlds largest companies providing service in the subsea and offshore markets. revenues of around 6.5 billion Euros. and i feel there should be more synergies which can be explored between the two.

happy investing!!

------------- Never give up your right to be wrong, because then you will lose the ability to learn new things and move forward with your life--- Dr. David M. Burns |

Posted By: samir767

Date Posted: 26/Sep/2010 at 12:03pm

|

on a similar note i would also like to share an interesting article i had read in the web. read below extract of that article.

for full article, here is the link. http://www.dailymarkets.com/stock/2010/04/21/investing-in-offshore-oil/ - http://www.dailymarkets.com/stock/2010/04/21/investing-in-offshore-oil/

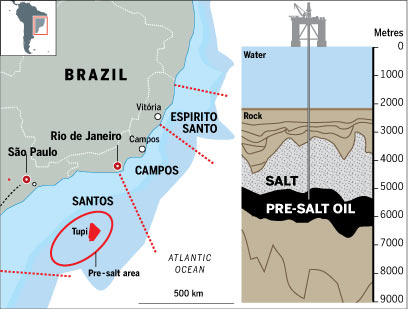

Could you work beneath 9,356 feet of seawater? That’s almost two miles, and no human being can survive in water that deep. How about going down there in a submarine? Could a Navy nuclear submarine operate that deep? Nope. I can’t tell you how deep Navy submarines dive (it’s classified). But I can say that 9,356 feet is more than four times deeper than the crush depth of even the most powerful sub. Human beings aren’t meant to go that deep. So, the trick is to build equipment that can do the work that needs to get done. And there are only a handful of companies in the world that can do that. To top if off, getting to the sea floor is only half the battle. Once you reach the seafloor, you need to go through another 10,000-20,000 feet of rock and salt formations to get to the oil. The chart below gives you a quick feel for it…

In short, offshore oil exploration work will require phenomenal levels of investment. Invest in the companies providing that infrastructure and you’re set to grow wealthy. I’ll show you how to play it in a second… But first, if you’re still skeptical about the prospects of drilling in water 10,000 feet deep… and then through 10-20,000 feet of salt formations, I can understand. So here’s proof that deepwater crude is only a matter of time – direct from one of the world’s leading oil men… ------------- Never give up your right to be wrong, because then you will lose the ability to learn new things and move forward with your life--- Dr. David M. Burns |

Posted By: vinvestor2010

Date Posted: 01/Apr/2011 at 10:05am

|

Wow what a flop prediction from me. I hope nobody bought the stock after reading this thread. |

Posted By: barla

Date Posted: 02/Apr/2011 at 1:51am

|

You should look at this positively.

Probably the first on TED where an individual is expressing such strong regret.

Hopefully you will learn a lesson and caution other i investors from falling into a smilar trap.

|

Posted By: vinvestor2010

Date Posted: 03/Apr/2011 at 6:16pm

Following are the facts from my observations

In last 3 quarters company has had losses of -22.69 cr,-9.26 cr,-9.93 cr, -15 cr (approximate by me). This would total to a loss of about Rs -57 cr for FY 2010-11.

The good news is that last year they had 2 quarters of profits EACH of nearly 50 cr.

So even with this horror year they can survive.

Last year closing they had a cash balance of Rs 255 cr and 0 debt.

If we assume that all losses are cash and some more cash is spent maybe in capex,dividend etc then the cash loss of 57 cr can say be upped to 100 cr.

So it would still have AT LEAST about Rs 150 cr in cash or investments.

The market cap is Rs 322 cr now. So about 45% or Rs 47-48 per share is in cash IMHO.

Logically sir then even if company just does break even it should go to share price of Rs 150+.

However after 1 goofup I will not make any prediction

Markets can remain irrational longer than we can remain solvent - Keynes

IMHO this is an extended case of mispricing but Mr Market is the boss ultimately so now time to pray to Balaji :-)

|